New regulatory frameworks and requirements from banks and other stakeholders are making climate and environmental protection a management issue. What needs to be done to make your company ESG-ready? ESG & Sustainable Finance: Is your company already prepared for this?

For several years, we have been discussing new regulatory frameworks for companies in order to achieve the decarbonization of the European economy by 2050.

In the current year, 2024, the next important milestone comes into effect with non-financial reporting for large companies. The gradual implementation of the EU Action Plan on Financing Sustainable Growth means that climate and environmental goals, sustainable financing, and sustainability risks are becoming part of ordinary business activities: larger companies are directly affected by the new requirements, but in fact, all companies-sooner rather than later-will be impacted. What does this mean in concrete terms? And how well is your company already prepared for this?

EU Action Plan or How to Finance Sustainability

With the publication of the EU Action Plan on Financing Sustainable Growth (2018)- EU Action Plan: Financing Sustainable Growth– the term “sustainable finance” gained significance for financial market participants who, until then, had hardly engaged with sustainability. The starting point for these measures is the Paris Climate Agreement, in which the international community agreed in 2016 to a 1.5 or 2-degree climate target compared to pre-industrial levels. How this is to be achieved and the role of the financial sector can be found in Article 2/Section 1c, which explicitly states that “international financial flows are to be aligned with the climate goals.”

In the following, we will address the connections between (1) regulatory requirements and the information needs of business partners, especially banks. From this, (2) necessary measures for companies can be derived to ensure the long-term success of their business models.

The EU Action Plan specifies three key objectives across 10 points:

- Redirecting capital flows toward sustainable investments

- Integrating sustainability risks into economic considerations

- Promoting transparency and long-term thinking in financial and economic activities,

while initially targeting the financial sector, these measures now impact all companies. By involving financial intermediaries, the groundwork was laid to enable the transition of the European economy under the Green Deal (2019).

Banks Require Additional Information…

The EU Action Plan is the starting point for numerous EU regulations, such as the Disclosure Regulation (SFDR), Taxonomy Regulation, and Corporate Sustainability Reporting Directive (CSRD). Since mid-2022, banks have been obligated to disclose sustainability-related information about their operations and integrate it into client advisory processes.

To meet transparency and non-financial reporting obligations, banks must evaluate their credit portfolios for sustainability risks, taxonomy alignment, and financed emissions (Scope 3). The results are reported using the Green Asset Ratio (GAR), which measures the share of sustainable financing relative to total exposures. Despite current low GAR values (often single-digit due to data quality issues), this metric is expected to improve and become a competitive factor among banks.

While demand for sustainable (re)financing products remains limited, sustainable investments in asset management have grown significantly in recent years.

…From Their Business Clients

To fulfill reporting requirements, banks need additional data from their corporate clients. Assessing sustainability risks is not just a compliance burden but also an opportunity to make credit portfolios more resilient to environmental, transitional, or legal risks. This aligns with strategic decisions about portfolio sustainability and which business models to finance.

Financing the green transition enables banks to develop new products (e.g., ESG-linked loans, ESG-linked Schuldscheine, Green Bonds) and services. Similarly, public funding programs increasingly favor sustainable investments through ESG incentives. Thus, ESG and sustainable finance present both challenges and opportunities for banks-and consequently, for their clients. ESG & Sustainable Finance-Are You Prepared?

What Does Your Company Need to Prepare for ESG?

While banks, financial service providers, and large companies have been preparing for ESG requirements for years, many SMEs still believe they are unaffected. However, all companies with bank loans will face demands for non-financial data in the short to medium term. Those in international supply chains will also need to provide this data to help clients comply with directives like the CSDDD. So what should be done?

ESG ASSESSMENT

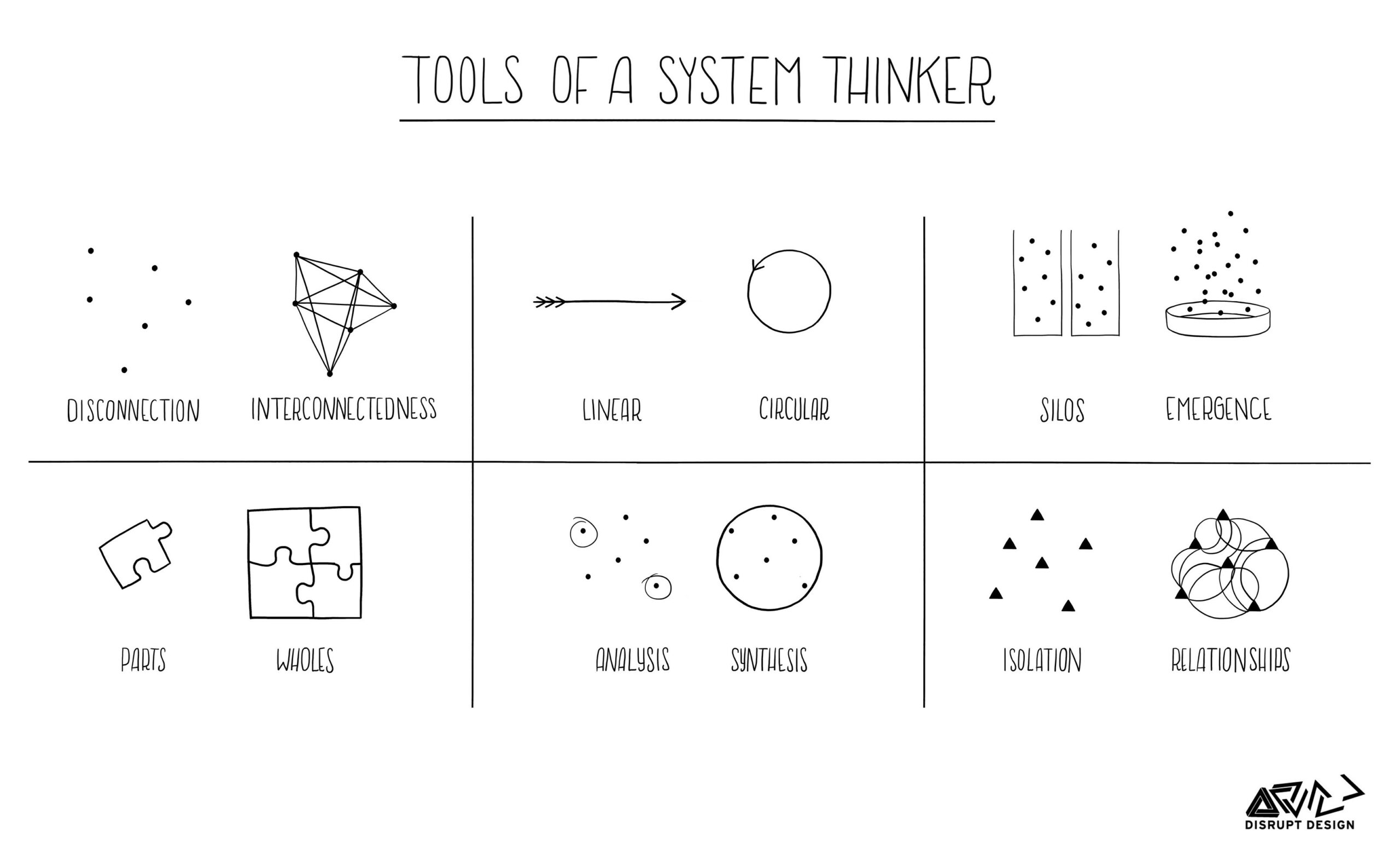

Every company, regardless of size or sector, must conduct an individualized ESG assessment. This involves evaluating all business areas, products, stakeholders, and financial relationships to identify direct/indirect impacts of non-financial regulations. Three core action areas follow:

What? – Methods & Data Identify tools like double materiality analysis (inside-out/outside-in), climate transition plans, and climate risk assessments. Establish an internal control system (ICS) for sustainability. Prioritize data quality and availability (internal/external quantitative data), which is currently the biggest challenge. Use data not just for compliance but for proactive business steering.

How? – Processes & Tools. In order to manage the extensive new ESG data landscape, new or adapted digital tools and systems are required, and, as far as possible, automation of data collection and processing should be implemented to reduce manual sources of error. ESG measures must gradually become an integral part of decision-making, budgeting, and incentivization, to name just a few.

Who? – Know-How & Responsibilities It is often underestimated-even by companies already engaged with ESG-that the new ESG requirements demand detailed know-how, typically combined with relevant application experience. Therefore, it is essential to build expertise through training and development within the company, ensuring this spans all functions, hierarchies, and geographic reference points. Equally critical is defining clear roles and responsibilities, establishing the corresponding line organization, and, of course, adapting governance.

Sustainable finance therefore affects the investment, lending, and asset management sides of companies across all industries. The necessary measures go far beyond those responsible for finance and finance departments and, for many business models, require new strategic challenges and a systemic, holistic approach to addressing them. Numerous support measures are available to companies for this purpose: industry associations, funding programs, comprehensive training and continuing education offerings , as well as ESG consulting firms with many years of experience.

This means that nothing stands in the way of a successful ESG strategy and its implementation in your company! Further below you will find the most frequently asked questions (FAQs) on the topic of ESG & Sustainable Finance.

Heidrun Kopp is a long-standing finance expert with a focus on sustainability, head of the training program “ESG & Sustainable Finance” at FHWien der WKW, and representative of the Vienna location (Terra Institute).

THE MOST FREQUENTLY ASKED QUESTIONS ABOUT ESG & SUSTAINABLE FINANCE – FAQS

1. Why do decarbonization measures start in the financial sector?

The requirements of the Paris Climate Agreement call for the implementation of extensive climate and environmental goals, especially to significantly reduce European CO2 emissions. The necessary infrastructure costs (including expansion of railways, renewable energies) are currently estimated to require around €400-600 billion per year.

To be able to manage investments of this scale, it is not only the public sector but especially the financial sector that is needed: money is the lever for decisions about which projects are financed and in which companies or projects investments are made. In order to accomplish this, the (capital) market requires legal certainty and clearly defined rules, concrete quantifiable KPIs, and transparency through standardized non-financial reporting.

2.What do the terms sustainability, CSR, and ESG mean?

Sustainability is an umbrella term used in an economic context when decisions are made to consider not only economic but also ecological and social impacts (People – Planet – Profit).

Corporate Social Responsibility (CSR) is especially common in the corporate sector; under this concept, sustainable activities are usually realized in companies in the form of individual environmental and social projects.

Environment-Social-Governance (ESG) is a term increasingly used in the economic context and complements environmental and social concerns with the governance aspect. Examples of what is specifically meant by this:

- Environment: Climate, resource scarcity, water, environmental pollution, biodiversity

- Social: Employees, training, safety, health, demographic change, food security

- Governance: Risk and reputation management, supervisory structures, compliance, corruption

3.FROM WHEN MUST THE REPORTING OBLIGATION UNDER CSRD BE IMPLEMENTED?

- Financial year starting 01.01.2024 for companies already subject to Non-Financial Reporting (NFRD)

- Financial year starting 01.01.2025 for “large” companies or groups not previously required to report

- Financial year starting 01.01.2026 for capital market-oriented small and medium-sized enterprises as well as small credit institutions

- Financial year starting 01.01.2028 for specific third-country companies

4. NON-FINANCIAL REPORTING STANDARD (NFRD) - WHAT DOES IT MEAN?

For many years, sustainability reports have been a way for companies to present their ecological and/or social engagement. In addition to social projects and the daily apple for employees, especially double-sided printing of paper was not to be missed in any report. With the national implementation of the Non-Financial Reporting Directive (NFRD), large companies have been required to provide non-financial reporting since 2017. Even then, the EU Commission aimed to encourage more intensive engagement with sustainability in large, capital market-oriented companies through increased transparency. The number of companies affected by the EU directive is manageable, and both the reporting standard (often the Global Reporting Initiative, GRI) and the reported content were freely selectable. As a result, the measures taken by companies were not comparable. The NFRD was a first step, but it quickly became clear that defined framework conditions (→ CSRD) were unavoidable.

5. WHAT ARE SUSTAINABILITY RISKS?

These are financial risks arising from climate change, resource scarcity, environmental degradation and/or social problems. A distinction is made between physical, transient and, increasingly, liability risks. Physical risks include chronic risks such as rising sea levels, thawing permafrost, etc., as well as acute risks such as droughts, heavy rainfall, floods or even hurricanes, to name but a few. Less well known are transient risks. These result from short-term changes in legislation (CO2 tax), technology (e-mobility) and consumer behaviour (flexitarianism, veganism). Finally, liability risks arise from the increasing number of environmental lawsuits.

6. WHAT ARE THE 10 ACTION POINTS IN THE EU ACTION PLAN?

The EU Action Plan contains 10 action points to be implemented by the financial sector, which will have a particular impact on companies in the real economy, in order to achieve a green transformation:

|

Goal |

Action Point |

|

Aligning capital flows towards a sustainable economy

|

1. Establish an EU classification system for sustainability activities 2. Create standards and labels for green financial products 3. Promote investments in sustainable products 4. Make sustainability part of investment advice 5. Develop sustainability benchmarks 6. Better integrate sustainability into ratings and research

|

|

Anchoring sustainability in risk management

|

7. Clarify the obligations of institutional investors and asset managers 8. Include sustainability in regulatory requirements |

|

Promoting transparency and long-termism

|

9. Strengthen sustainability disclosure and accounting standards 10. Strengthen sustainable corporate governance and reduce short-termism in capital markets |

https://terra-institute.eu/esg-und-sustainable-finance/