MODERN COMPANIES THAT ARE MINDFUL OF SUSTAINABILITY USE A VARIETY OF INSTRUMENTS TO IMPLEMENT POSITIVE CHANGE. THEY TAKE MEASURES IN THE AREA OF THE ENVIRONMENT, E.G. TO REDUCE POLLUTION BEYOND LEGAL LIMITS. IN THE AREA OF SOCIAL AFFAIRS, FOR EXAMPLE, WITH VOLUNTARY CONTRIBUTIONS TO IMPROVE WORKING CONDITIONS FOR EMPLOYEES IN THE VALUE CHAIN.

In any case, it concerns voluntary contributions by economic actors to sustainable development, which should go significantly beyond the legal requirements in order to go ‘beyond compliance’.

Two key requirements can be identified when analysing the resulting opportunities and risks for companies:

1.Understanding sustainability as a long-term economic and future opportunity, investing today for a better future tomorrow, means

2.Serving recognisable and communicable social demands, i.e. standing out as a company that acts responsibly.

FROM ESG TO EESG AS THE ‘STATE OF THE ART’ OF SUSTAINABLE TRANSFORMATION

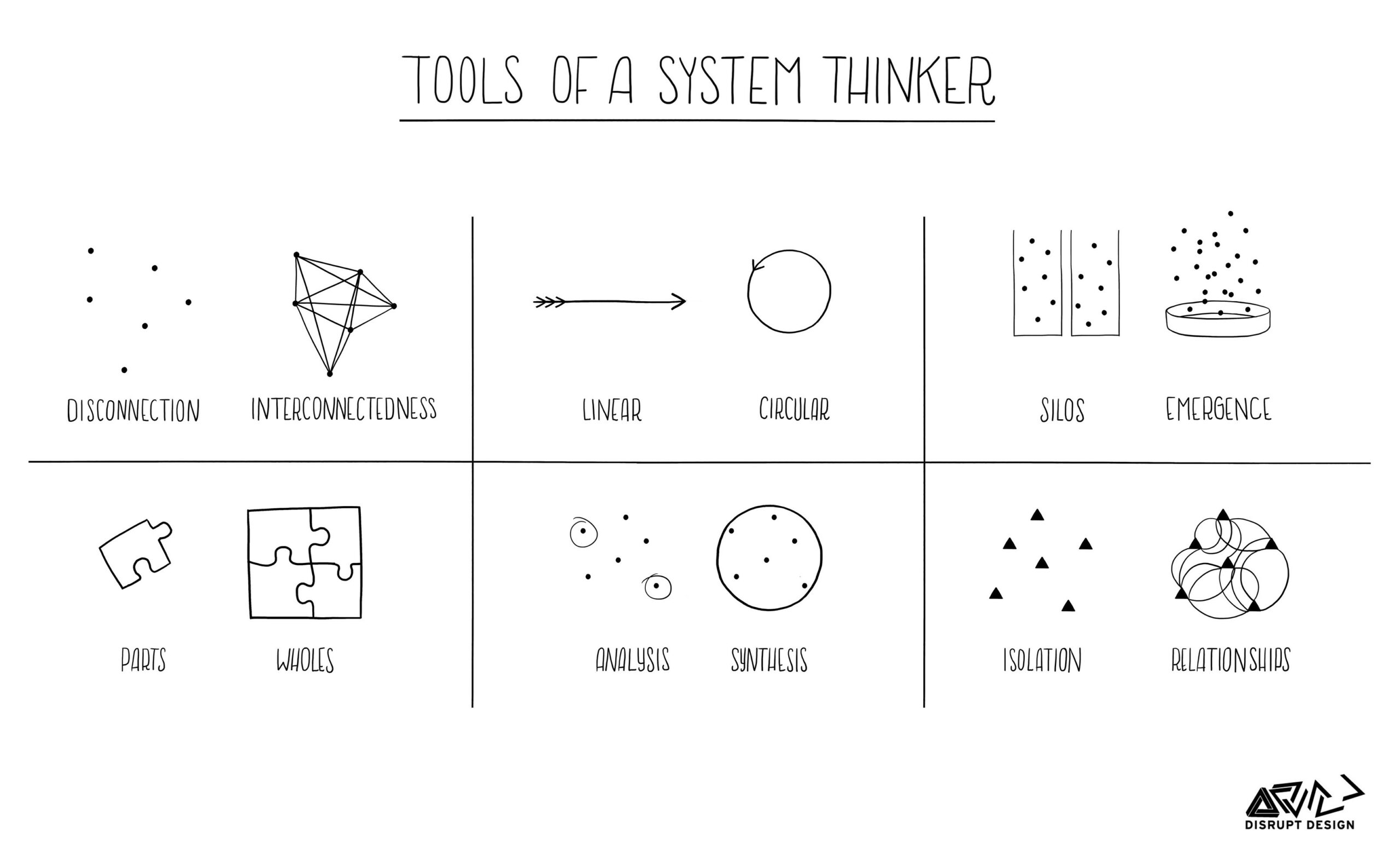

In view of the omnipresent effects of the climate and environmental crisis in its ecological, social and economic dimensions, the need to take appropriate measures into account when making business decisions can no longer be questioned. The exploitation of human and natural resources, the scarcity of energy and raw materials, the exclusively linear economy with its gigantic amounts of waste and, above all, the clearly noticeable effects of climate change require a systemic change at macro and micro level. A holistic view of sustainability aspects must be given entrepreneurial attention.

In principle, a company’s understanding of sustainability is determined by its sector, business model, market position, size and also its maturity. Companies go through different stages of addressing the issue as they develop. They each lead to a specific adaptation behaviour, from purely reactive, reacting to changes, to proactive, consciously helping to shape them. Now, at the latest, is the time to deal intensively and comprehensively with opportunities and risks from a corporate perspective in the context of ESG compliance.

ESG stands for ‘Environment’, “Social” and ‘Governance’, that means the simultaneous and equally balanced consideration of environmental and social issues, and this is firmly anchored in all corporate management processes.

My broader interpretation of the acronym (EESG) explicitly and visibly includes the economic dimension in the abbreviation. After all, all three dimensions of sustainable development must be considered equally within the governance structure.

I therefore see EESG or E²SG as state-of-the-art in the modern perception of social responsibility. This emphasis is intended to underline the equal consideration of all dimensions in the integration and implementation of the necessary programmes for ‘beyond ESG compliance’.

UNDERSTANDING CSRD AND CSDDD AND APPLYING THEM IN THE SENSE OF RISK MANAGEMENT

The correct interpretation of the regulations on sustainability reporting – CSRD (Corporate Sustainability Reporting Directive) and the Supply Chain Act – CSDDD (Corporate Sustainability Due Diligence Directive) enables this well-founded consideration of the future viability of companies as a first step. On the one hand, the relevant impacts of the company on nature and society must be identified unconditionally within the framework of ‘double materiality’. On the other hand, the external influences that could jeopardise the value creation model must also be named without reservation, in the sense of extended risk management (business continuity management)

Of course, ‘beyond ESG compliance’ means thinking beyond the regulatory requirements, i.e. voluntary contributions by companies towards sustainable development, which should, however, go significantly beyond the legal requirements.

THE BEST LEADERS RESPECT THE LAWS THAT GOVERN THEIR INDUSTRY, BUT THEY KNOW THAT THIS ALONE IS NOT ENOUGH TO BE RECOGNISED AS A RESPONSIBLE COMPANY IN THE FUTURE. KEY POINT: BEYOND ESG COMPLIANCE!

Modern and therefore sustainability-oriented companies make use of an innovation-oriented anchoring of the topic of ESG in the organisation in order to consistently address the aspects mentioned above. This is anchored in the organisational structure and processes. The resulting strategies, programmes and measures are often difficult to implement, but also offer interesting management tasks, as it is not enough for the sustainable transformation of the company to exclusively address individual measures or only react to pressure. In concrete terms, this means that managers must exemplify the values of the organisation in their actions, regardless of whether they are dealing with personnel issues, guidelines or the reaction to a scandal. This shows once again why corporate governance based on compliance is necessary but not sufficient.

The organisation of the future will require significant change along the entire value chain. Starting with a rethink of the business model, the procurement process and the production processes, which will have to be organised more efficiently. But also changes to the product or the product itself in order to exploit market opportunities. However, the advantages of being the first to try this, such as higher margins, setting standards, product differentiation or product attractiveness and image enhancement, can also be offset by considerable risks. These can include lost investments in research and development, problems with the reorganisation of processes and quality costs. But demand uncertainties and information deficits among customers also play a role here.

DEFINE, MEASURE AND ‘LEAD’ ESG KEY FIGURES

To this end, the key performance indicators that enable management from an EESG perspective must be defined in the right places, as developed in the materiality analysis.

The framework of KPIs (Key Performance Indicators) is therefore expanded to include ecological and social indicators, as well as indicators relating to social commitment. These KPIs must also be used for operational management and should not only be collected for annual reporting. Here too, the CSRD and the ESRS (Environmental and Social Reporting Standards) provide practical and applicable guidelines that need to be fulfilled.

In order to incorporate sustainability into corporate planning and to empower and motivate the entire company, coordinated measures must be taken and measured in all functional areas.

BEYOND ESG COMPLIANCE

Companies that want to make themselves fit for the future through sustainable transformation go ‘beyond ESG compliance’ with their actions.

They see sustainability as long-term economics and an opportunity for the future. They make investments today for a better future tomorrow.

As a company that acts responsibly, these companies address recognisable and communicable social demands and take them into account in all areas of responsibility.

Author

Werner Kössler a technician and business economist, is an expert in sustainability management and circular economy with 30 years of experience across various industries and companies. In leadership roles, he has successfully implemented numerous complex projects aimed at improving corporate sustainability performance—always embedded within broader organizational development programs.

His vocation and passion lie in actively shaping companies toward a conscious and holistic approach to sustainability and circularity.

When strategies are properly designed and corresponding measures are implemented, economic benefits inevitably follow—because sustainability is long-term economics.