IN A WORLD THAT IS BECOMING INCREASINGLY INTERCONNECTED AND COMPLEX, THERE IS GROWING PRESSURE ON COMPANIES TO PRESENT THEIR SUSTAINABILITY STRATEGIES AND THEIR IMPACT CLEARLY AND TRANSPARENTLY. THE DOUBLE MATERIALITY ANALYSIS PLAYS A KEY ROLE HERE. BUT WHAT EXACTLY DOES THIS TERM MEAN AND HOW DO YOU GO ABOUT CARRYING OUT SUCH AN ANALYSIS? LET’S DELVE INTO THE WORLD OF DOUBLE MATERIALITY AND DISCOVER HOW IT HELPS COMPANIES TO BETTER UNDERSTAND THEIR RESPONSIBILITY AND CONNECTION TO ESG ISSUES WHILE ENSURING FINANCIAL STABILITY.

Key Takeaways

-

1.The dual materiality analysis looks at two dimensions: a company’s material impact on the environment, society and the economy, or ESG issues (impact materiality) and the financial impact of ESG issues on the company (financial materiality)

2.The dual materiality analysis plays a central role in the European Sustainability Reporting Standards (ESRS), which define a clear framework and requirements for comprehensive and transparent reporting.

3.The ESRS entail challenges such as complex data collection and stakeholder involvement. However, they also bring with them a central approach to improving the sustainability performance and competitiveness of companies.

WHAT IS DOUBLE MATERIALITY?

Dual materiality refers to the consideration of two dimensions of materiality in corporate reporting. Firstly, the direct and indirect impacts on society (e.g. the company’s own workforce, labour in the value chain, affected communities, end users and consumers), the environment (e.g. climate change, pollution, water and marine resources, biodiversity or the circular economy) or governance issues (e.g. corporate culture, whistleblowers or corruption). Secondly, how these topics impact the company financially in terms of financial materiality. These two perspectives provide a more comprehensive and in-depth insight into a company’s interactions with its environment and stakeholders.

- Impact materiality: This dimension assesses the company’s impact on the environment and society. This includes the environmental footprint, social impact and compliance with governance practices. Companies are assessed according to how their business activities generate external effects that can have both positive and negative consequences for the environment and society.

- Financial materiality: This dimension focusses on the financial impact of environmental, social and governance (ESG) issues on the company. The focus here is on how these issues can influence the financial position, performance and development of a company. This corresponds to the traditional perspective of investors who are interested in how risks and opportunities related to ESG issues could affect a company’s financial stability and profitability.

Fig. 1: Dual Materiality – Approaches to Materiality

STEPS FOR CARRYING OUT A DOUBLE MATERIALITY ANALYSIS

1. Identification of relevant topics: The first step is to understand the company’s own value creation as well as the upstream & downstream value chain. It is important to identify the topics from the company’s value chain that actually trigger or could trigger financial risks and opportunities or impacts. This can be done, for example, by analysing internal and external sources, market studies, stakeholder surveys and industry reports.

2. Assessment of impact materiality: This involves assessing the impact of business activities on the environment and society. This includes the analysis of environmental impacts (e.g. CO2 emissions), social impacts (e.g. working conditions) and governance aspects (e.g. ethical behaviour).

3. Assessment of financial materiality: Companies must assess the potential financial impact of the identified ESG issues. This can be done through risk assessments, scenario analyses and financial modelling to understand how these issues could impact financial results.

4. Stakeholder engagement: An essential part of the dual materiality analysis is dialogue with stakeholders. This includes customers, employees, investors, communities and NGOs. By involving these groups, a more comprehensive picture of the material issues and their impact can be created.

5. Integration and reporting: The results of the analysis must be integrated into the corporate strategy and reporting. This means that companies should align their sustainability goals and strategies with the identified material topics and communicate them transparently.

ADVANTAGES OF DOUBLE MATERIALITY ANALYSIS

The double materiality analysis offers numerous advantages:

• More comprehensive risk assessment: by considering both financial and impact materiality, companies can better identify and manage risks and opportunities.

• Increased transparency and credibility: Transparent reporting on material ESG issues strengthens stakeholder trust and can improve the company’s reputation.

• Sustainable corporate development: The integration of ESG issues into the corporate strategy promotes sustainable and long-term value creation.

CHALLENGES AND OUTLOOK

Despite its advantages, the dual materiality analysis also presents challenges. These include the complexity of data collection and assessment, the need for comprehensive stakeholder engagement and continuous adaptation to changing regulatory requirements. Nevertheless, dual materiality remains a key starting point for companies that want to improve their sustainability performance and communicate it transparently.

In light of the existence of the VSME draft for small and medium-sized enterprises, the importance of the dual materiality analysis will continue to increase. Companies that adopt this approach early and comprehensively can not only better achieve their sustainability goals, but also strengthen their competitiveness and resilience in a changing world.

CONCLUSION

Dual materiality analysis is a powerful tool for assessing and communicating companies’ ESG performance. It helps to build a bridge between financial and societal goals and enables companies to develop a sustainable and forward-looking strategy. In a world where sustainability and transparency are becoming increasingly important, dual materiality offers a clear way to meet the diverse demands of stakeholders while ensuring long-term success.

Author

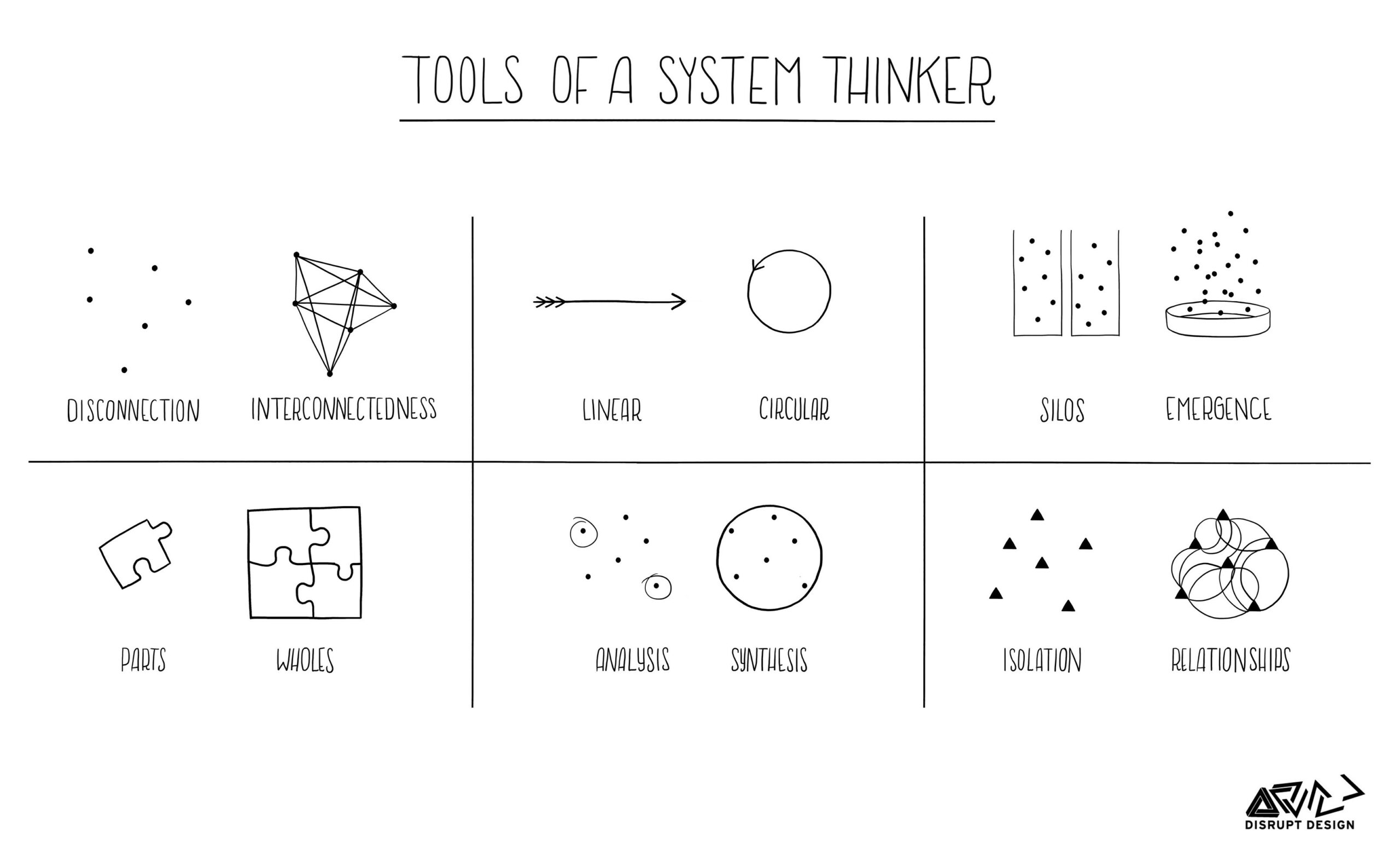

Evelyn Oberleiter Co-founder and CEO of Terra Institute. She has been accompanying companies in deep transformation processes for 20 years and focuses on organizational development, corporate culture processes, and sustainable leadership approaches. Evelyn possesses high process competence and result orientation, extensive analytical and reflective abilities, high communication skills, and a pronounced systems thinking. As a personal coach, she primarily accompanies people in top management.