How Medium-Sized Companies Make Better Decisions, Stabilize Costs and Secure Their Future

Medium-sized companies are used to achieving a lot with limited resources. That is precisely why sustainability is particularly suitable for SMEs – if it is properly understood.

Not as an obligation, not as an additional task, but as a management instrument. Energy, material use, supply chains and social risks now significantly influence costs, investments, financing and growth.

Companies that systematically integrate these factors into their business strategy gain an advantage. Not through more effort, but through better decisions.

1. What It Means to Integrate Sustainability into Business Strategy

Embedding sustainability strategically means above all one thing for medium-sized companies:

Taking it into account where value is created and decisions are made.

Not in isolated measures.

Not in separate reports.

But as part of:

- Products and services

- Processes and resource use

- Procurement and supplier relationships

- Investment and budget decisions

- Leadership, culture and organization

The goal is not to launch additional projects, but to make existing decisions more robust and future-proof. Energy consumption, material use, emissions and social risks become business management variables – comparable to costs, quality and lead times.

Sustainability thus becomes part of good corporate governance.

2. Why SMEs in Particular Benefit

SMEs have short decision-making paths and close proximity to value creation. This is a key advantage.

Companies that systematically integrate sustainability achieve tangible economic effects:

- Lower costs through more efficient use of energy and materials

- Better access to financing, because banks require reliable information

- More stable customer relationships, especially with large companies and public-sector clients

- Lower risks in supply chains, in legal compliance and in cost increases

- Higher attractiveness as an employer, especially for qualified professionals

Sustainability enables companies to manage proactively rather than merely reacting to external requirements.

3. The Biggest Levers for Economic Added Value

In practice, three areas have emerged in which medium-sized companies can achieve impact particularly quickly.

Lever 1: Operational Efficiency and Cost Structure

The greatest lever lies in ongoing operations.

Typical starting points include:

- Increasing energy efficiency

- Waste heat recovery and own electricity generation

- Modernization of machinery and IT

- Reduction of scrap, waste and material losses

Practical example:

A metal processing company invests in waste heat recovery and a photovoltaic system.

The result is significantly lower heating costs, additional income from fed-in electricity and greater planning security for energy costs.

Here, sustainability has a direct impact on the company’s profitability.

Lever 2: Products, Services and Business Models

Sustainability unfolds its full potential when it is thought of close to the product.

Possible starting points:

- Extending product lifetimes

- Repair and service offerings

- Reuse of materials or products

- Development of resource-efficient or regional product lines

Practical example:

A trading company sets up a small unit for refurbishing returns.

A large proportion of the goods can be resold, disposal costs fall, and at the same time additional contribution margin is generated.

Here, sustainability drives revenue, not just cost reduction.

Lever 3: Transparency, Data and Steering Capability

Many companies lose time and money because relevant information is not available in a structured way.

Even simple steps have major impact:

- Measuring energy and resource consumption

- Central collection of relevant key figures

- Structured supplier questionnaires

- Regular short evaluations instead of extensive reports

Practical example:

A mechanical engineering company measures the energy consumption of individual machines.

The mere transparency leads to changes in processes, resulting in measurable savings – without additional investments.

Transparency enables control.

Control creates economic benefit.

4. The Risks of Inaction

Not acting is no longer a neutral option today.

Companies that do not integrate sustainability risk:

- Rising financing costs

- Loss of revenue due to changing customer requirements

- Increasing energy and raw material costs

- Difficulties in attracting and retaining skilled workers

- Organizational and legal risks due to missing information

The longer companies wait, the higher the pressure to adapt and the associated costs.

5. A Pragmatic Three-Step Path

Step 1: Create Orientation

The goal is to quickly gain an overview and set priorities.

This includes:

- Defining a few material sustainability topics

- Clear responsibility within the company

- Recording initial key figures

- Regular short exchanges within the management team

The result is greater clarity and first economic effects.

Step 2: Build Structure and Priorities

In the next step, sustainability is systematically embedded in decisions.

This includes:

- Consolidating measures with an assessment of effort and benefit

- Simple assessment of suppliers

- Continuous monitoring of energy and materials

- Involving employees in improvement processes

Sustainability thus becomes manageable and controllable.

Step 3: Anchor Sustainability in Corporate Management

In the long term, sustainability becomes part of strategic management.

This includes:

- Considering relevant KPIs in investments and budgets

- Further development of products and services

- Training of managers and teams

- Structured preparation of information for banks and customers

Sustainability thus becomes a lasting competitive advantage.

Conclusion

For medium-sized companies, sustainability does not (only) mean more bureaucracy, but:

- better decisions

- more stable costs

- more robust business models

- a stronger market and employer position

Those who integrate sustainability early and pragmatically into their business strategy create economic leeway – today and for the future.

Further article

Basis article: ESG as a success factor

Author

Evelyn Oberleiter

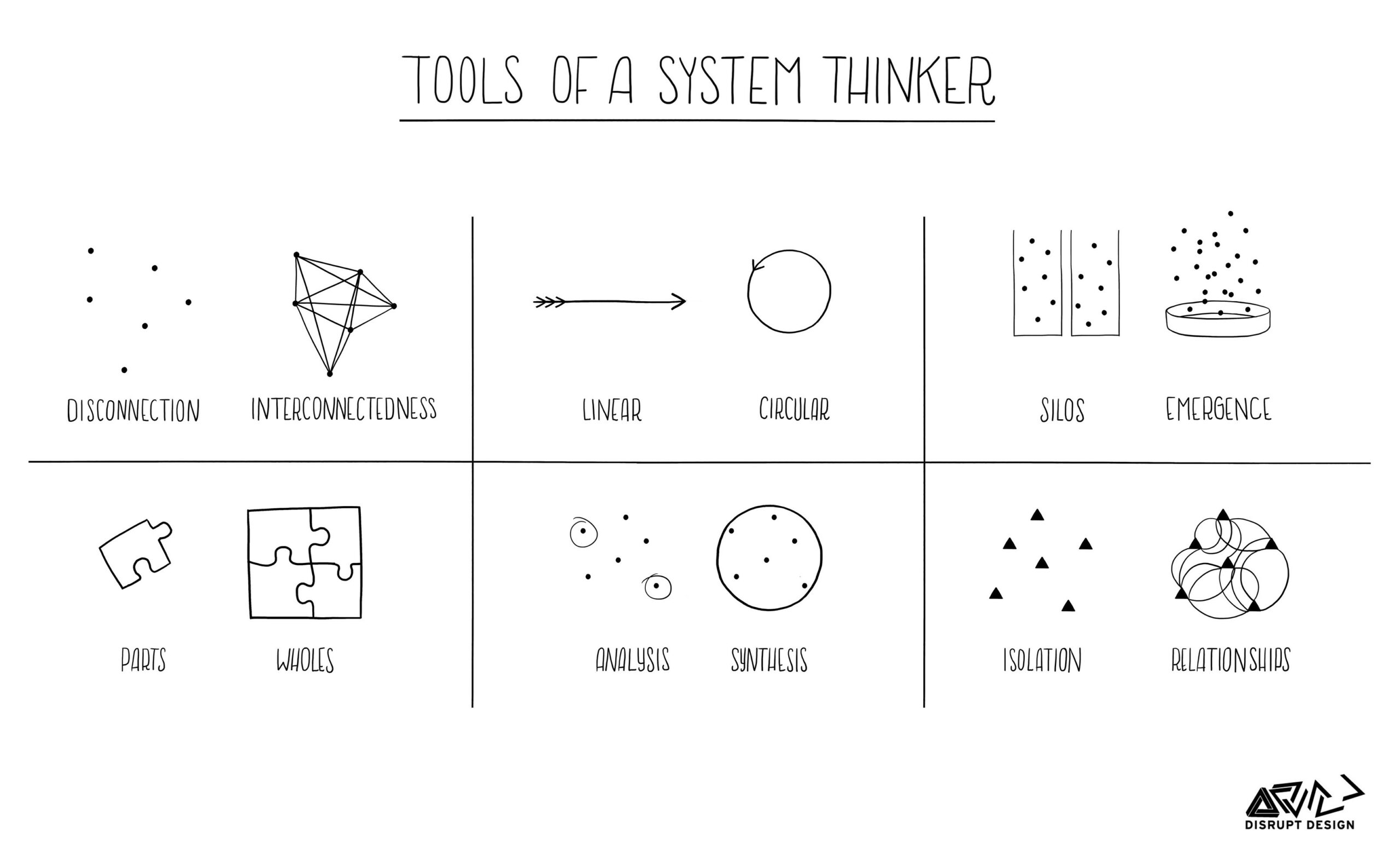

Co-founder and CEO of Terra Institute. For 20 years she has been supporting companies through profound transformation processes, with a focus on organizational development, corporate culture processes and sustainable leadership approaches. Evelyn has strong process competence and a high level of result orientation, extensive analytical and reflection skills, excellent communication skills and a pronounced systems-thinking mindset. As a personal coach, she primarily supports people in top management.

Questions? Feel free to get in touch by e-mail (e.oberleiter@terra-institute.eu).