FAQS ON THE CORPORATE SUSTAINABILITY REPORTING DIRECTIVE (CSRD) – PART 1

THE CORPORATE SUSTAINABILITY REPORTING DIRECTIVE (CSRD) IS AN EU DIRECTIVE THAT AIMS TO STANDARDISE AND IMPROVE SUSTAINABILITY REPORTING BY COMPANIES. THE EU WANTS TO PUT SUSTAINABILITY AT THE HEART OF THE ECONOMY AND STEER FINANCIAL MARKETS TOWARDS A MORE SUSTAINABLE FUTURE.

It does this by requiring companies to report and be audited on their sustainability performance. The CSRD promotes transparency, enabling investors and other stakeholders to make more informed decisions, thereby helping to reduce environmental impacts and promote social responsibility. The CSRD is specified by the European Sustainability Reporting Standards (ESRS), which structure the process of identifying material issues and content to be reported. The CSRD: EU Sustainability Reporting Directive – Who is affected and when?

WHAT DOES THE CSRD REGULATE?

The Non-Financial Reporting Directive (NFRD) has regulated sustainability reporting in the EU since 2014. In November 2022, the EU Parliament adopted the Corporate Sustainability Reporting Directive (CSRD). This will replace the NFRD.

The CSRD regulates how companies report on their sustainability practices and performance. It requires companies to include information on environmental issues, social issues, labour rights, diversity, corporate governance and more in their reports. The Directive is specified by the European Sustainability Reporting Standards (ESRS), which structure the process of identifying material issues and content to be reported. This information must not only be quantitative, but also include qualitative statements that illustrate the company’s impact on society and the environment. Companies need to ensure that the information in their reports is reliable and comparable, as it must also be audited.

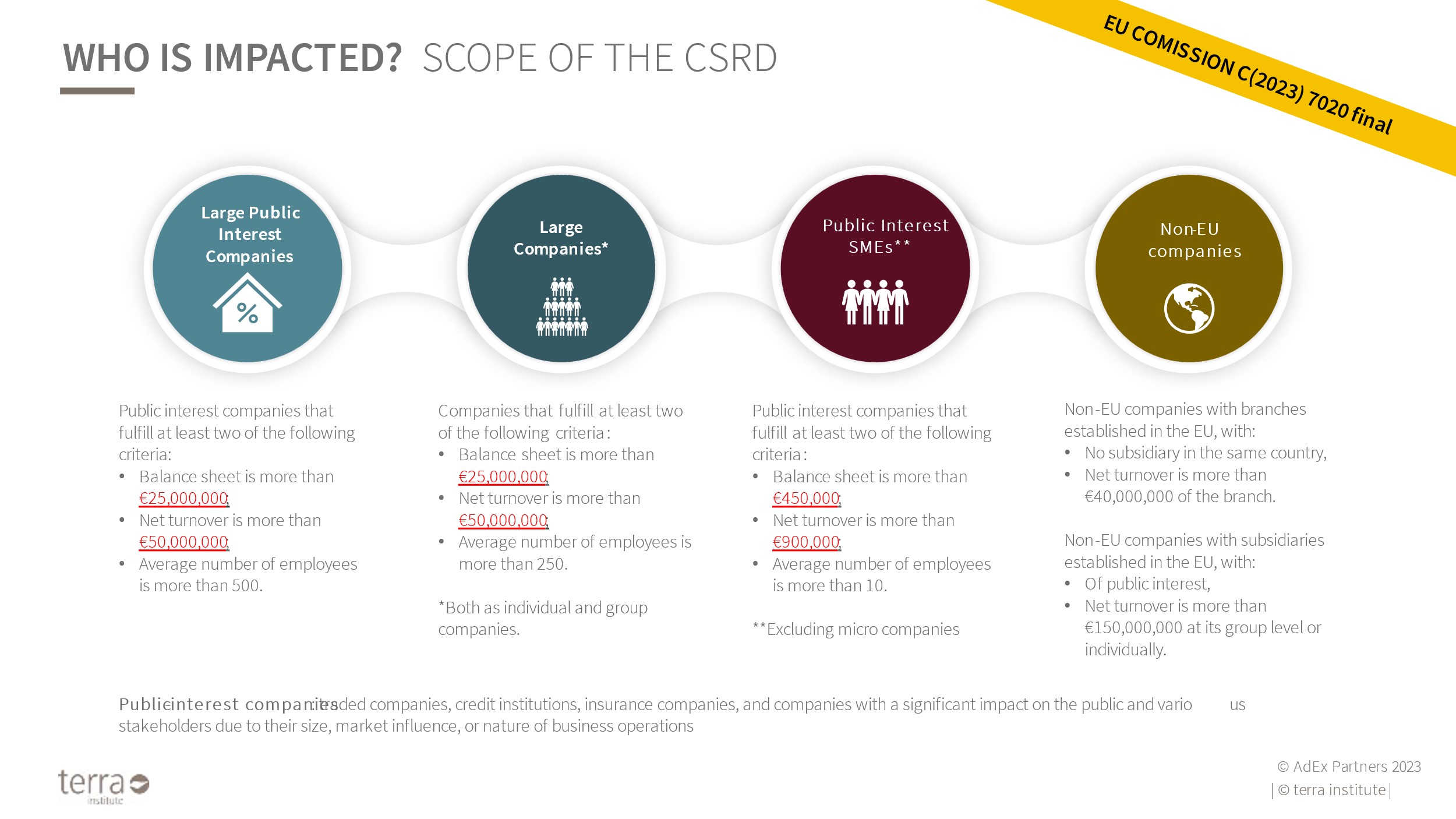

WHO IS AFFECTED BY THE CSRD AND WHO HAS TO REPORT AND WHEN?

The CSRD applies to a wide range of companies in the EU. These include large listed companies, banks, insurance companies and certain other organisations. From the 2024 financial year, these companies will be required to prepare and publish comprehensive sustainability reports. The CSRD thus significantly extends the scope of the previous Non-Financial Reporting Directive (NFRD).

However, not all companies will be required to do so from the outset. The first reports will be prepared for the 2024 financial year by public interest entities & parent companies with 500 or more employees in their balance sheet for the financial year. One year later, starting with the 2025 financial year, all other companies & parent companies that are considered large will report under the CSRD for the first time. Small and medium-sized enterprises in the public interest, small non-complex credit institutions and captive insurance companies will start reporting for the 2026 financial year. Third country entities with turnover in the EU, as described above, will have to report for the first time for the 2028 financial year.

(SOURCE: Zahlen stammen aus dem “Impact Assessment” der EU Kommission vom 21.04.2021; “Annex 17: Cost Analysis”, welche vom Centre for European Policy Studies (CEPS) erstellt wurde) https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021SC0150

The Terra Institute works intensively on CSRD. It is an integral part of the consultancy projects!

Overall, the CSRD is an important step towards a more sustainable business world in the EU. Companies should be aware that they are now directly or indirectly obliged to publish their sustainability practices and performance in a detailed and transparent manner. Investors and consumers can benefit from this increased transparency by making better-informed decisions and pushing companies to act more responsibly. The CSRD is therefore an essential building block on the road to a greener economy in Europe.