HAVE YOU ALSO TRIED TO UNDERSTAND ALL THE SUSTAINABILITY ACRONYMS IN RECENT MONTHS? CSRD TO IFRS: CLARITY IN SUSTAINABILITY REPORTING.

The provisions of the CSRD Directive have ensured that sustainability is now on the agenda of many companies. Large listed companies are already thinking beyond the regulatory requirements and considering how they can use the issue to positively influence the market and their employees. Many smaller companies are still hesitant. This is understandable given the flood of guidelines, regulations, abbreviations, and uncertainties. From CSRD to IFRS: clarity in sustainability reporting—we want to briefly summarize the most important points here and put them into context.

MAIN DRIVERS FOR ENTREPRENEURIAL SUSTAINABILITY

In our study, “PATHWAYS TO SUSTAINABILITY,” we identified three main drivers for sustainability as a corporate strategy.

First, when sustainability is understood as part of the core business, it is broader and more strategic. Second, it is an opportunity to improve one’s reputation and attractiveness. Third, pressure is growing from the supply chain and legislators. A fourth driver comes into play when you are dependent on external capital. The EU Action Plan: Financing Sustainable Growth has been in force since 2018.

Fig. 1: The EU Action Plan on Financing Sustainable Growth is one of the key drivers of the transition to a sustainable economy in the EU.

For banks, this means that since mid-2022, they have been required to report sustainability-related information about their business activities and, in particular, to assess their loan portfolios in terms of sustainability risks, compliance with taxonomy, and financed emissions (Scope 3). The result is represented by the share of sustainable financing in total receivables, the “green asset ratio” (GAR). All companies that have taken out a loan from their bank will face the challenge of providing sustainability data, facts, and figures in the short to medium term.

HOW DO COMPANIES PROVIDE THIS SUSTAINABILITY DATA?

How do companies provide this sustainability data? They do so through sustainability reporting. It is not only financial institutions that are interested in companies’ sustainability reporting. Customers, trading partners, and suppliers are also interested in their own sustainability reports, as are employees and the general public. The legal basis for this is the EU’s Corporate Sustainability Reporting Directive (CSRD) from 2022. The aim is to improve comparability by standardizing sustainability reporting, increase transparency through double materiality and consideration of global impacts, including for non-EU companies, and raise the quality requirements for sustainability reporting to the level of financial reporting. This affects companies with total assets of €25 million or more, revenues of €50 million or more, and/or 250 employees or more.

ESRS, GRI, DNK, IFRS – ALL JUST REPORTING STANDARDS

With the CSRD, the EU is also providing its own reporting standard: the European Sustainability Reporting Standards (ESRS). In the future, the ESRS will be the standard according to which all companies in Europe report. These reporting standards specify how the report should be structured. Roughly speaking, the report consists of two elements:

Sustainability analysis of the status quo & identification of key sustainability issues

Determination of the strategic level of ambition for sustainability & description of the transformation path to get there.

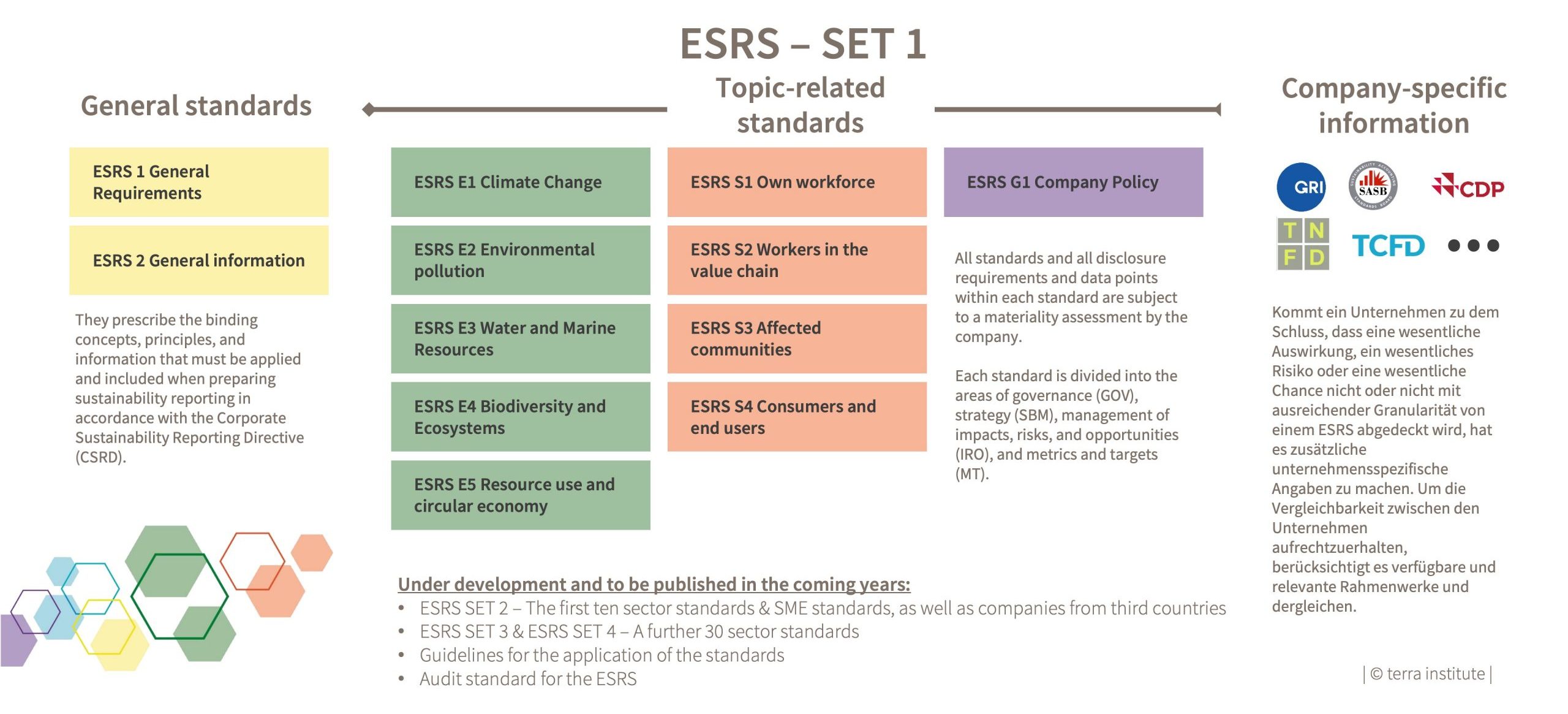

Let’s take a closer look at the ESRS. The first SET of the ESRS consists of general standards that contain general principles of reporting and disclosure, and thematic standards on environmental, social, and corporate governance issues. Only material issues need to be reported on later. However, it can be assumed that, for example, “ESRS E1 Climate Change” or “ESRS S1 Own Employees” can generally be considered material for a company. The respective standard then describes how the issue is to be addressed and which sustainability indicators are to be described. In the future, the second SET of the ESRS will publish further industry standards and standards for SMEs and companies from third countries.

Fig. 2: The ESRS in the current overview.

CSRD TO IFRS: CLARITY IN SUSTAINABILITY REPORTING – DIFFERENT REPORTING STANDARDS

The ESRS is not the only reporting standard currently in use. To name just a few, the German Sustainability Code (DNK) is very common in German-speaking countries. The Global Reporting Initiative (GRI) is more widely used internationally. For globally active companies, the International Financial Reporting Standards (IFRS) of the International Sustainability Standards Board (ISSB) will play a role in the future. It can be assumed that these standards will be compatible to a certain extent in the future.

The ESRS are explicitly structured in such a way that company-specific impacts that are not described in detail in the ESRS can be integrated through the approach of other reporting standards. The European Financial Reporting Advisory Group (EFRAG), which was originally set up to support the EU in adopting international accounting standards and also played a key role in developing the ESRS, also provides many valuable pointers on how sustainability reporting can be structured in operational terms. The findings of the Task Force on Climate-related Financial Disclosures (TCFD) and the Task Force on Nature-related Financial Disclosures (TNFD) are also often helpful.

MORE THAN 45 CONSULTANTS GIVE YOU THE GUIDANCE YOU NEED

So it’s not easy to keep track of exactly how a sustainability report needs to be structured in order to withstand an audit. And we haven’t even mentioned the integration of the EU taxonomy or the due diligence requirements in the supply chain under the European Supply Chain Due Diligence Directive (CSDDD), which should also ideally be reflected in the sustainability report. In addition, there are other initiatives that, while not mandatory, could be taken into account when developing a sustainability strategy, such as the Science Based Targets initiative (SBTi).

CSRD TO IFRS: CLARITY IN SUSTAINABILITY REPORTING THROUGH TERRA

Our goal at the Terra Institute is to give you back your sense of direction. To this end, we have developed our reference book “So tickt Nachhaltigkeit” (How Sustainability Works) with many educational videos and an optional seminar (Only available in German).

Or do you already have a specific question? Then let’s get to know each other: office@terra-institute.eu