Sustainability Reporting

Your path to transparency, ESG compliance, and long-term success

/ OUR OFFER

SUSTAINABILITY

REPORT

Transparency as a success factor: Why sustainability reporting makes all the difference today

Sustainability reporting is no longer a “nice-to-have” – it is a business-critical success factor and the new standard for companies that want to remain future-proof. Companies that clearly communicate their ESG strategies position themselves as trustworthy market leaders, comply with legal requirements, and increase their attractiveness to investors, customers, and talent. At the same time, they identify and minimize risks along the supply chain and open up new business opportunities.

A professional sustainability report is not just a document – it is a strategic opportunity to secure competitive advantages, overcome regulatory hurdles, and strengthen your company’s innovative power. Companies that act sustainably today will be ahead tomorrow. The question is no longer whether a company needs a sustainability report – but how quickly it implements one to position itself as an industry pioneer.

Current legal framework

There are a wide variety of sustainability standards around the world. Some are voluntary reporting standards, while others are legally binding reporting standards. Here is an overview of the most commonly used sustainability reporting standards in Europe.

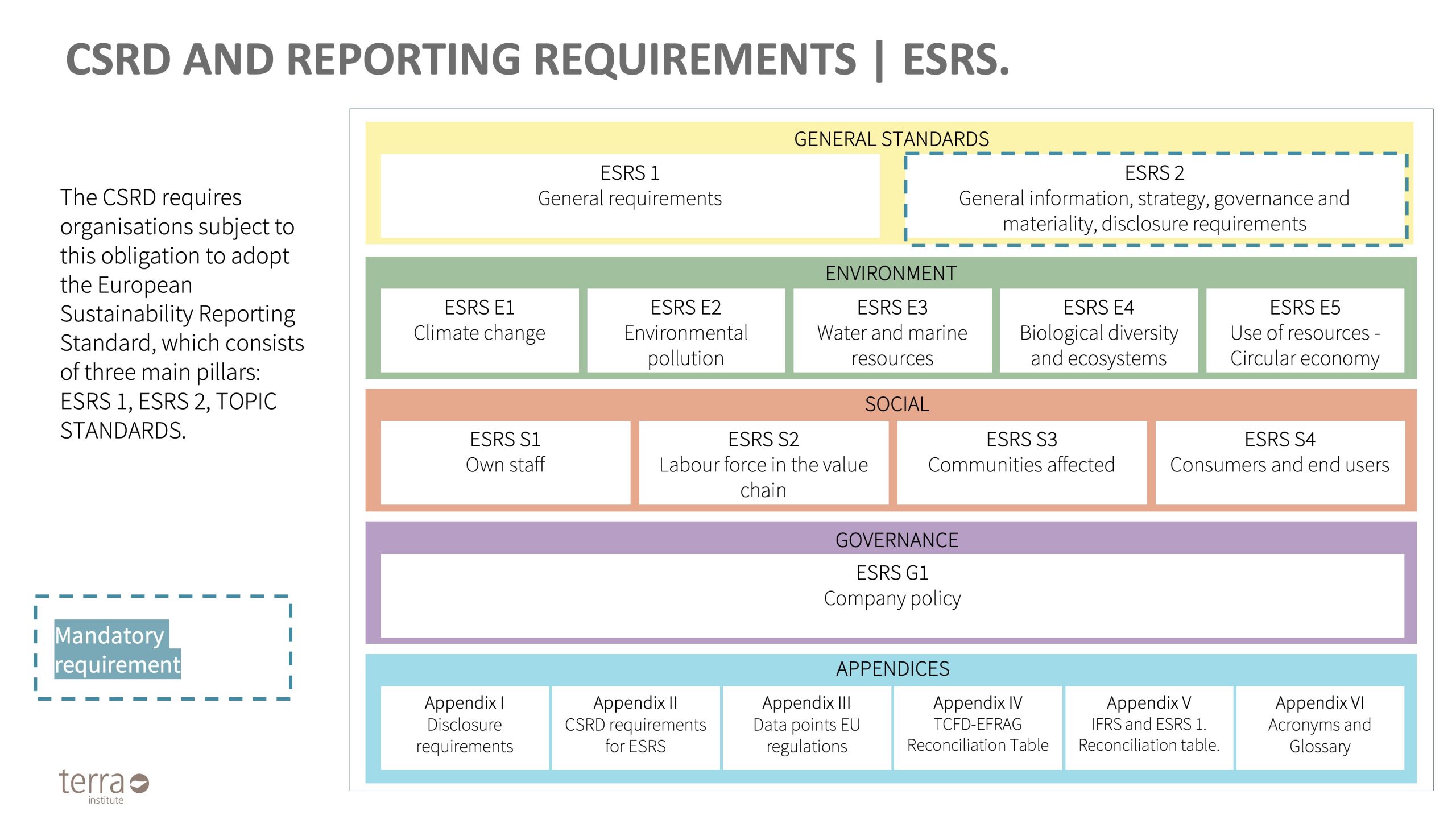

In the EU, the Corporate Sustainability Reporting Directive (CSRD) set new standards for sustainability reporting. The scope and reach of the CSRD is currently being called into question by the European Commission’s omnibus proposal. However, companies within the EU still have to comply with very strict disclosure requirements, depending on their size and business activities. Mandatory reporting is carried out in accordance with the European Sustainability Reporting Standards (ESRS).

THE COMPANIES

WHO HAVE CHOSEN US

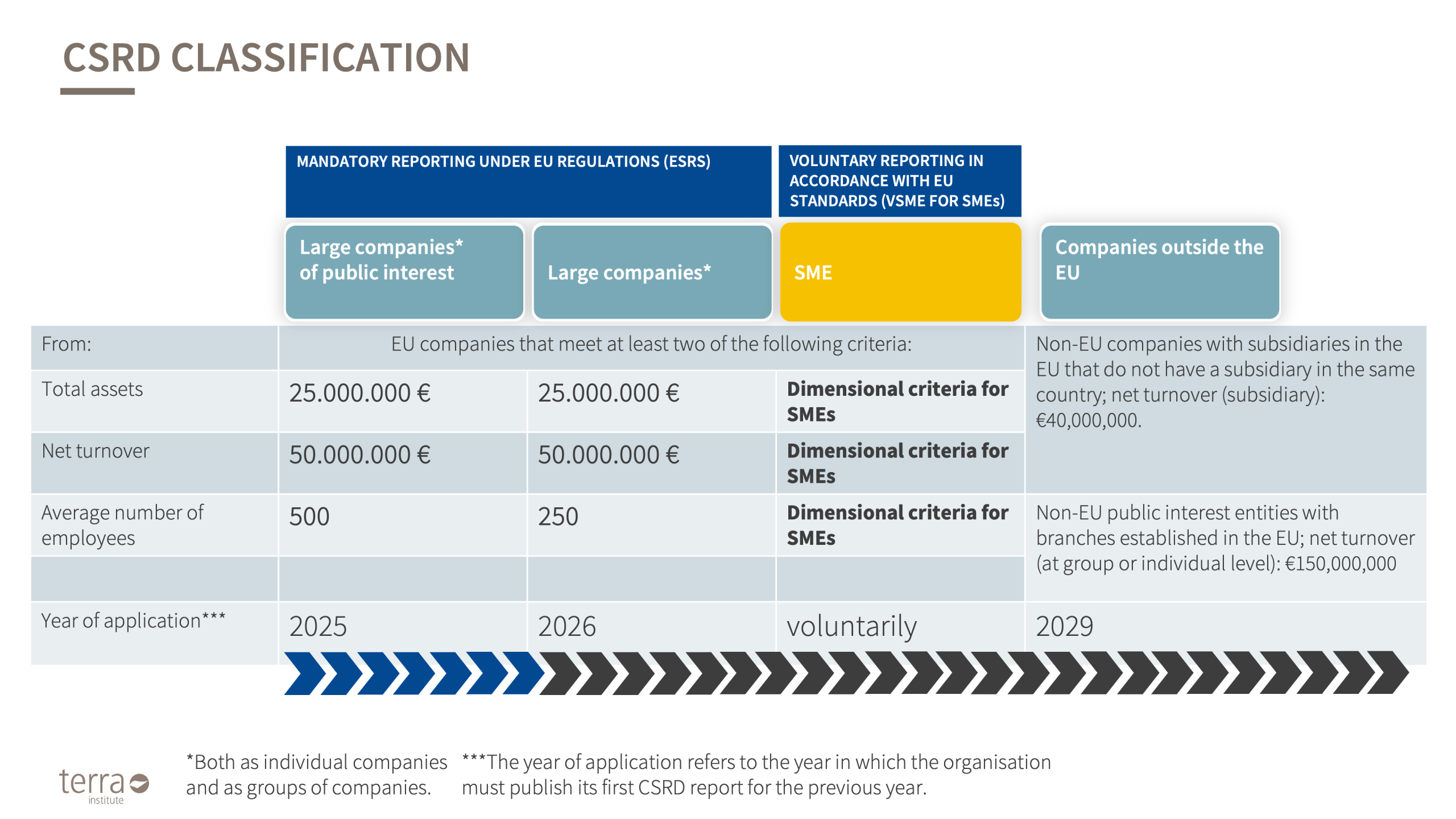

Who is currently subject to reporting requirements (this could change shortly due to the EU Commission’s omnibus proposal) ?

1. Large public-interest entities (individual companies or groups of companies) that meet at least two of the following criteria:

Total assets of ≥ €25 million

Net turnover of ≥ €50 million

At least 500 employees

→ Year of application: 2025

2. Large companies in general (not listed on the stock exchange) that meet at least two of the following criteria:

Balance sheet total of ≥ €25 million

Net turnover of ≥ €50 million

At least 250 employees

→ Year of application: 2026

3. Capital market-oriented SMEs can voluntarily seek certification under the VSME for SMEs.

→ Year of application: voluntary from 2026

4. Non-EU companies with an economic presence in the EU:

- Companies with branches in the EU that do not have a subsidiary in the same country must report if their net turnover exceeds €40 million.

- Companies with subsidiaries based in the EU must report if their net turnover (at group level or individually) exceeds €150 million.

→ Year of application: 2029

The CSRD requires companies to provide comprehensive information on the following ESG topics:

- Business model and strategy with regard to sustainability

- Governance and corporate management in the ESG context

- Environmental and social impacts, including climate risks

- Supply chain and value chain transparency

- Measurable ESG indicators in accordance with EU taxonomy

Companies that take early action not only ensure compliance, but also gain a decisive competitive advantage.

Would you like more detailed information about the process? Download our roadmap to the CSRD process here.

The roadmap is currently only available in German. Please contact us if you would like the roadmap in English.

The VSME sustainability standard offers small and medium-sized enterprises (SMEs) practical guidance for sustainability-related reporting in line with the CSRD (Corporate Sustainability Reporting Directive) and the principles of double materiality. Particularly in view of increasing regulation and transparency requirements along the supply chain, it is becoming increasingly important for SMEs to disclose their environmental, social and governance aspects in a structured manner.

The VSME standard consists of two modules:

- Basic – a compact introduction that enables companies to start structured reporting.

- Comprehensive – in-depth reporting for companies that have to meet more comprehensive sustainability requirements.

This modular structure allows companies to develop their reporting step by step in a resource-efficient manner. The advantages of VSME include reduced bureaucracy, greater credibility with stakeholders and better preparation for regulatory requirements. At the same time, the standard strengthens the competitiveness of SMEs by promoting a transparent and strategic approach to sustainability.

Let us create your VSME report – request your individual quote now!

Would you like more detailed information about the process? Download our roadmap for the VSME process here:

The roadmap is currently only available in German. Please contact us if you would like the roadmap in English.

How do customers benefit from our experience?

✔ Competitive advantage & capital access: 88% of institutional investors consider ESG performance a decisive factor for investment decisions.

✔ Compliance with legal obligations: Sustainability reporting is standardized and mandatory through CSRD, GRI & ESRS.

✔ Transparency & trust: Stakeholders prefer companies with credible sustainability strategies.

✔ Risk management along the supply chain: Identification and mitigation of ESG risks and improvement of corporate resilience.

✔ Cost savings & efficiency increase: ESG-compliant companies reduce operational costs by up to 20%.

✔ Attractiveness as an employer: 76% of employees prefer companies with clear sustainability strategies.

✔ Improved market position: 64% of consumers make purchasing decisions based on sustainable values.

WHY CHOOSE TERRA?

Terra Institute has been a pioneer in sustainable corporate consulting for over a decade. We accompany companies in ESG transformation, implementation of the EU taxonomy, supply chain compliance, and integration of sustainable strategies. Our holistic consulting approach combines:

- Practical ESG expertise with deep industry knowledge

- Data-driven solutions to create reliable sustainability reports

- Tailored consulting adapted to your specific requirements and reporting standards

- State-of-the-art ESG tools to make CO₂ footprints, social impacts, and governance indicators measurable

WHAT IS OUR APPROACH?

Our proven approach to creating a sustainability report follows a structured and practice-oriented process:

1. Analysis & scoping: We define goals and scope of the report together with you.

2. Data preparation & double materiality analysis: Identification of material ESG topics and relevant performance indicators.

3. Sustainability strategy & measures: Development of concrete KPIs and strategies to improve sustainability performance.

4. Creation & review: Drafting the report according to relevant standards with professional quality assurance.

5. Approval & publication: Support in final implementation and communication of the report via various channels.

THE MOST FREQUENTLY ASKED QUESTIONS ON THE TOPIC OF SUSTAINABILITY REPORTS – FAQS

1. WHAT IS A SUSTAINABILITY REPORT?

2. WHAT SHOULD A SUSTAINABILITY REPORT INCLUDE?

An overview of the organisation’s sustainability strategy, goals and objectives.

An organisational profile

Information on the company’s governance structure, management approach and stakeholder engagement activities

Information on the organisation’s environmental impacts, including data on energy and water consumption, greenhouse gas emissions, waste and recycling

Information on the organisation’s social impacts, such as labour practices, employee diversity and their community involvement

Data on the economic impact of the organisation

Future sustainability goals and strategies and the strategies to achieve them.

3. IS A SUSTAINABILITY REPORT MANDATORY?

For example, large companies in the EU are affected if they exceed two of the following three criteria: more than 250 employees, more than €40 million in net sales, more than €20 million in total assets.

However, small & medium-sized capital market-oriented EU companies must also comply with the obligation if they exceed at least two of the three criteria: ten employees, €700,000 in net sales and/or €350,000 in total assets.

Covered companies must disclose in their sustainability report, among other things, non-financial information on the following topics:

Business model, strategy, resilience, opportunities and compatibility with the transition to a sustainable economy.

Targets and objectives

Governance, policies and practices

Key impacts

Business risks related to sustainability factors

Businesses need to provide information appropriate to these issues:

qualitative and quantitative

retrospective and forward-looking

provided with short, medium and long-term time horizons

Furthermore, the placement of the disclosure plays a role: the sustainability report must be integrated into the management report.

Completely independent of the given legal requirements, many companies voluntarily prepare an annual sustainability report, as they see it as part of their commitment to transparency.

4. WHAT ARE THE ADVANTAGES OF A SUSTAINABILITY REPORT?

It increases transparency about the company’s sustainability performance.

It increases stakeholders’ trust in the organisation.

It leads to improved risk management in relation to climate change, resource depletion and social unrest.

It helps identify opportunities associated with sustainability issues.

It increases accountability as companies hold themselves accountable for their sustainability performance.

It helps to set clear goals and targets and track compliance.

It motivates a company to improve its sustainability performance and take action to address issues.

It provides a platform to share sustainability issues with others.

It can give organisations a competitive advantage by demonstrating their commitment to sustainability and setting them apart from the competition.

It can help attract customers and employees who value sustainability.

5. WHO IS AFFECTED BY CSRD AND WHO IS REQUIRED TO REPORT FROM WHEN ON?

Within the EU, certain companies of public interest have had to report on their sustainability for a few years now. Since 2014, this has been regulated by the Non-Financial Reporting Directive (NFRD). In November 2022, the EU Parliament adopted the Corporate Sustainability Reporting Directive (CSRD), which replaces the NFRD.

With the CSRD, both the scope and the type of non-financial reporting will change profoundly in the future, especially with regard to sustainability aspects. Affected from now on are:

Large companies that meet two of the following three criteria:

→ a balance sheet total of at least 20 million euros;

→ a net turnover of at least 40 million euros; or

→ an average number of employees of 250 in the business year (European Commission, 2021).

Small & medium-sized enterprises, excluding micro-enterprises, in the public interest (e.g. listed SMEs), which meet two of the following three criteria:

→ a balance sheet total of at least 4 million euros;

→ a net turnover of at least 8 million euros; or

→ an average number of employees of 50 in the financial year (European Commission, 2021).

Parent companies of large enterprise groups that meet two of the following three criteria at the consolidated level:

→ a balance sheet total of at least 20 million euros;

→ a net turnover of at least 40 million euros; or

→ an average number of employees of 250 in the financial year (European Commission, 2021).

Companies in third countries with a turnover of €150 million in the EU whose subsidiaries achieve a turnover of more than €40 million. According to estimates, this means that 49,000 companies will be subject to reporting requirements in the EU as a whole instead of 11,600 in the past (European Commission, 2021).

However, this will not all happen at the same time. The first reports will be made on the financial year 2024 by companies & parent companies in the public interest that show a number of employees greater than or equal to 500 in their balance sheet for the financial year. One year later, starting with the financial year 2025, all other companies & parent companies considered large will report for the first time in accordance with the CSRD. Small and medium-sized public interest entities, small non-complex credit institutions, and captive insurance companies will start reporting for the financial year 2026. And the above-described companies in third countries with turnover in the EU will be obliged to report for the first time with the financial year 2028 (European Commission, 2021).

Contacts

Do you have any questions or would you like our support on your way to becoming a sustainable company?

The easiest way to get in touch with us is here!

Please note our Privacy Policy and conditions.

Thank you very much! We look forward to receiving your message!

office@terra-institute.eu

Tel. +39 0472 970 484.

-

BRESSANONE HEADQUARTERS

Terra Institute Srl

Via Sant'Albuino 2

39042 Bressanone (BZ)

Italy

INNSBRUCK OFFICE AUSTRIA WESt

Terra Institute Austria FlexCo

Karl-Kapferer-Straße 5

6020 Innsbruck

Austria